- Abstract— Cloud Computing is viewed as something that will revolutionize everything on the web, based on SaaS (Software as a Service) model. Its key feature includes “pay as you use” economic model that is believed to be a breakthrough in Information Technology. Islamic banking is a system of banking or banking activity that is consistent with the principles of Islamic law (Shariah) and it has been present in many of the Muslim as well as non Muslim countries. This paper demonstrates some of the exciting features of Cloud and how it will bring benefits to Islamic Banking Industry. Index Terms— Cloud Computing, Islamic Banking on Cloud, Software as a Service. A suitable definition for Cloud Computing is: “A large-scale distributed computing paradigm that is driven by economies of scale, in which a pool of abstracted virtualized, dynamically-scalable, managed computing power, storage, platform, and services are delivered on demand to external customers over the internet.”[1] There are a few important points in the above definition: 1) Cloud Computing is a specialized form of distributed computing, 2) it is massively scalable, 3) users outside the cloud can avail different level of services delivered by Cloud, 4) and the services provided by Cloud are delivered on demand. [1] In Cloud Computing People can be users of SaaS or providers of Utility Computing. 1) the illusion of infinite computing resources available to the user on demand; 2) the relaxation in an advance commitment of resource usage by Cloud user; (as a result banks have the opportunity to increase their hardware resources only when there is an increase in their need.) 3) the privilege to pay for use of computing resources on short term basis, as per need and release them when no longer required. Fig1: the benefits of SaaS to both SaaS users and SaaS providers are shown. The highest level can be recursive in case when SaaS providers are also SaaS users. [2] - AIM Shariah-compliant assets have reached about $400 billion throughout the world in 2009, according to Standard & Poor’s Ratings Services [1], and the potential market is $4 trillion [3]. The State Bank of Pakistan has revealed that the Islamic banking industry has posted a growth of 12.4 percent during the quarter ended June 2009 and total assets of Islamic banking in Pakistan reached Rs 313 billion in June 2009[4]. In terms of market share, total assets, financing & investment and deposits reached 5.1 percent and 4.2 percent and 5.2 percent, respectively, at end June 2009. The branch network of 6 full-fledged Islamic banks and 12 conventional banks (with dedicated Islamic banking branches-IBBs) increased to 528 branches in June 2009. It is projected that Islamic banking industry will capture 12% share of total banking industry in year 2012[3]. Despite huge growth potential, Islamic banks still do not look towards cloud as a viable option to host their services. Even one of the biggest financial institutions of the world, Merrill Lynch predict that by 2011 the volume of cloud computing market opportunity will amount to $160BN, including $95N in business and productivity apps ( office, CRM, etc.) and $65BN in online advertising[7]. Our Aim is to show the Islamic banking industry that banking on the Cloud is a viable option and is vital for their growth. Both local and international banks are exploring the option of using cloud computing to their advantage and Islamic banking industry must not be left behind.

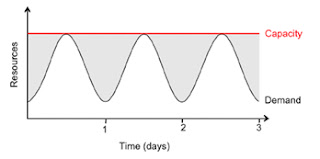

A major economic advantage of Cloud Computing is to convert capital expenses to operating expenses of bank. We know that on an average the server utilization in datacenters ranges from 5% to 20% [5, 6]. It may seem to be very low but it is consistent in a sense that many services at peak workload exceed the average by factor of 2 to 10[2]. Thus, this variation causes more waste at non-peak times but often companies cannot effort to go without this variation. For example, if we assume that our banking application has a predicable daily demand where the peak requires 1000 servers at noon but the trough requires only 200 servers at midnight, as show in Fig2(a), As long as the average utilization over entire day is 600 servers, the actual utilization over the entire day (shaded under curve) is 600 * 24 = 14400 server-hours; but since we must provision to the peak of 1000 servers we pay 1000 * 24 = 24000 server hours, a factor of 1.7 more that what is actually needed. Fig2 (a): If peak load can be correctly anticipated, without elasticity we waste resources (shaded area) during nonpeak times [2]. Suppose if we underestimate the peak load then the excess users will be receiving bad or low service. This will ultimately result in loosing potential users. For example, Suppose but 10% of users who receive poor service due to limited capacity are “permanently lost” opportunities. The site has enough capacity to handle an expected peak of 400,000 users (1000 users per server _ 400 servers), but an unexpected positive press drives 500,000 users in the first hour. Of the 100,000 who are turned away or receive bad service, by our assumption 10,000 of them are permanently lost, leaving an active user base of 390,000. If this pattern continues, after 19 hours, the number of new users will approach zero. Ultimately, the bank has collected less than 400,000 users’ worth of steady revenue during those 19 hours as well as bad reputation from the dissatisfied users. [2] Fig2 (b): some users desert the site permanently after experiencing poor service; this attrition and possible negative press result in a permanent loss of a portion of the revenue stream.

Clients will be connected to a highly available service layer that manages user-generated analysis tasks. Since each task may be composed of millions of path traversals, these can be delivered into an elastic set of Objectivity/DB-based search agents hosted in the cloud. Due to Objectivity/DB's unique distributed architecture, it does not rely on a single database server to perform queries, allowing the load of the database and link hunting operations to be distributed evenly across the cloud. This type of deployment is perfectly suited to banking systems with extremely high peak or continuous loads from thousands of concurrent users. During high demand, additional cloud resources can be provisioned to instantly increase the power of Objectivity/DB. When load resumes to normal levels, cloud resources can be trimmed to suit demand, achieving the ultimate mix of performance and efficiency. Fig3: It represents different hardware components used by the Banking System. In this diagram multiple Client Applications are shown. Here each application represents an instance of Islamic Banking System used by a single bank. The application of Islamic Banking System will be deployed on Amazon Virtual Private Cloud (VPC). The reason for this choice is security. Amazon VPC provides access to the cloud via Virtual Private Network thus, making it more secure as compare to any public cloud. The application will use Amazon Relational Database Service (Amazon RDS) as its main database. Amazon RDS is a web service that makes it easy to set up, operate, and scale a relational database in the cloud. It provides cost-efficient and resizable capacity while managing time-consuming database administration task. References [1] Ian Foster, “Cloud Computing and Grid Computing 360-Degree Compared”, 2008. [2] Michael Armbrust, “Above the Clouds: A Berkeley View of Cloud Computing”, 2009. [3] Asian Banker Analysis, Published August 26, 2009 [4] Pakistan’s Islamic Banking Sector Review 2003-07 [5] RANGAN, K. The Cloud Wars: $100+ billion at stake. Tech. rep., Merrill Lynch, May 2008. [6] SIEGELE, L. Let It Rise: A Special Report on Corporate IT. The Economist (October 2008). [7] FZI Research Center Research, Assistant Markus Klems [online].August 2008. Available from: http://cloudcomputing.sys-con.com/node/604936. Bibliography |

description

The Blog is all about my experience on Amazon Cloud

Poster Paper

Subscribe to:

Comments (Atom)